Trading and Financial Strategy Update

Paris, France | Jan 5, 2017

In a market that remains difficult, multi-client sales are estimated at circa $135 million in the fourth quarter of 2016, with a level of prefunding in line with target (a prefunding rate above 80% on an annual basis) but an after-sales volume below our expectations. At the Group level, Q4 revenues are expected to be the highest quarterly revenues of the year 2016.

Net debt should amount to circa $2.315 billion as at December 31 (at a €/$ closing exchange rate of 1.05, versus $2.304 billion as at September 30, at a €/$ closing exchange rate of 1.12), in line with the target to be below $2.4 billion at the end of 2016.

Given the difficult market environment, the Company, as a protective measure, engaged in discussions starting December 9 with various lenders (French and US revolving credit facilities and the Nordic loan) and they agreed on December 31 2016 to disapply the maintenance covenants (leverage ratio and coverage ratio) at that date.

In this context, with a market environment expected to remain similar in 2017 and to continue to weigh on its revenues, the Company considers that the Group's debt level is too high. It intends to commence discussions with all the stakeholders in their various jurisdictions in order to achieve a financial restructuring. The objective of this restructuring would be to provide the Company with a level of indebtedness and cost of debt that is substantially reduced and sustainably adapted to its revenues. To that end, the Company will make proposals to its creditors and to its shareholders. The market will be informed in due time of the outcome of these discussions.

In order to facilitate discussions with all stakeholders, the Company wishes to have the ability to request the appointment of an ‘ad hoc representative’ (Mandataire ad hoc), which requires the agreement of the relevant creditors, in accordance with the various credit agreements and bond documents.

Jean-Georges Malcor, CEO, CGG, said: “After the effective execution of our industrial Transformation Plan and in market conditions that are expected to remain very difficult, our priority is now to improve our balance sheet and quickly restore financial flexibility to the Company. At the same time, we remain fully committed to our commercial efforts, customer satisfaction, operational excellence, strict cost management and preservation of our liquidity level.”

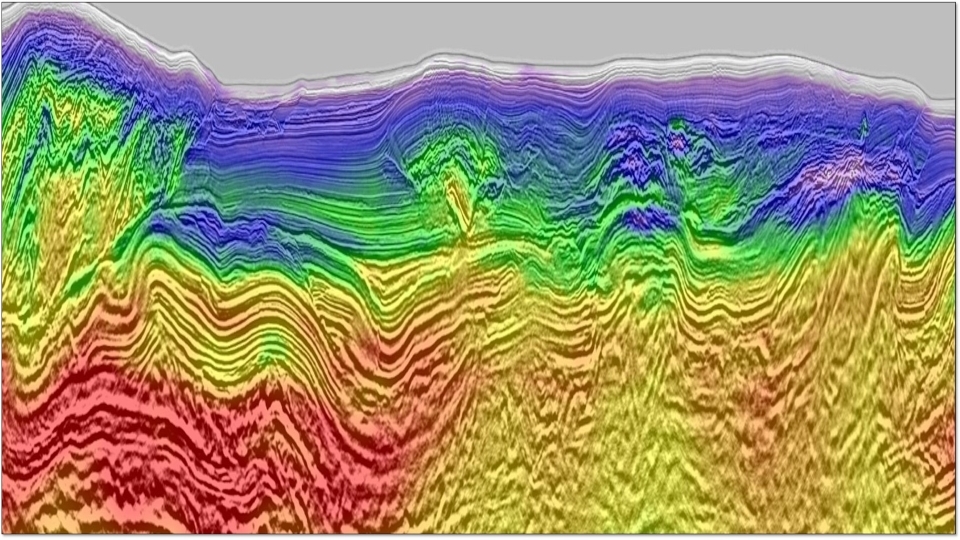

About CGG

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).