CGG Announces its Q1 2023 Results

Paris, France | May 3, 2023

A strong start to the year :

Revenue at $210m, up 37% y-o-y

Ebitda at $66m, up 71% y-o-y

CGG (ISIN: FR0013181864), a global technology and high-performance computing (HPC) leader, announced today its first quarter 2023 non-audited results.

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

“We delivered a strong start to the year, supported by robust performance in Geoscience, increased Earth Data sales, mainly in the Gulf of Mexico, and expected equipment deliveries in Sensing and Monitoring. I was pleased to see the continued progress of our Beyond the Core activities during the quarter, especially the signature of our first external HPC & Cloud Solutions contract, with Biosimulytics, supplying specialized HPC services to support their AI-enhanced molecular Pharma modelling.

Looking ahead, our clients are ramping up their longer-term exploration efforts with increasing emphasis on efficiency, effectiveness, and lowering their carbon footprint. Based on the market leading position of our advanced technology, across all Business Lines, and the continued growth of the digital and decarbonization markets, CGG is well positioned to answer the needs of our clients, reinforcing our confidence in delivering our 2023 objectives.”

Q1 2023: A strong start to the year

- IFRS figures: revenue at $178m, EBITDAs at $34m, OPINC at $7m

- Segment revenue at $210m, up 37% year-on-year.

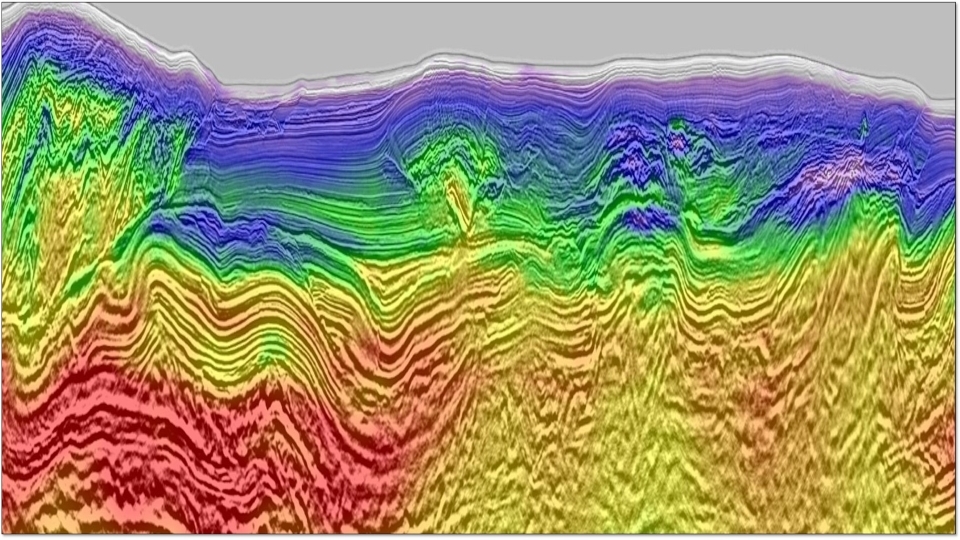

- Geoscience at $79m, up 5% year-on-year. Sustained growing activity worldwide and increased level of order intakes, up 31% year-on-year.

- Earth Data at $65m, up 47% year-on-year, as clients are returning to exploration. Prefunding revenue at $35 m and after-sales stable year-on-year at $30m.

- Sensing and Monitoring at $66m, up 95% year-on-year. Better quarter than anticipated thanks to early streamer equipment deliveries. Significant commercial opportunities for land equipment and OBN sales.

- Segment EBITDAs at $66m up 71% year-on-year, a 31% margin.

- Segment Operating income at $13m.

- Group Net loss at $(16)m.

Cash flow and balance sheet

- Net cash flow at $1m including $(4)m negative change in working capital & provisions.

- Cash liquidity of $301m as of March 31, 2023, excluding $95m undrawn RCF.

- Net debt before IFRS 16 at $905m as of March 31, 2023.

Post closing event

- On April 5, Fitch Ratings has upgraded CGG SA's to 'B' from 'B-', and its USD500 million and EUR585 million notes due 2027's seniorsecured rating to 'B+' from 'B'. The Recovery Rating on the notes is 'RR3'. The Outlook on the Long-Term IDR is Stable.

More:

Q1 2023 Conference call:

Participants should register for the call here to receive a dial-in number and code or participate in the live webcast from here.

A replay of the conference call will be made available the day after for a period of 12 months in audio format on the Company's website www.cgg.com.

About CGG

CGG (www.cgg.com) is a global technology and HPC leader that provides data, products, services and solutions in Earth science, data science, sensing and monitoring. Our unique portfolio supports our clients in efficiently and responsibly solving complex digital, energy transition, natural resource, environmental, and infrastructure challenges for a more sustainable future. CGG employs around 3,400 people worldwide and is listed on the Euronext Paris SA (ISIN: 0013181864).