The Appeals Court of Paris upholds the ruling of the Commercial Court of Paris that approved CGG’s safeguard plan

Paris, France | May 18, 2018

CGG announces that the approval of its safeguard plan by the Commercial Court of Paris on December 1st 2017 was upheld by a ruling rendered today by the Appeals Court of Paris, seized by a group of Convertible Bondholders that had launched a recourse against the draft plan.

“Senior Notes” means, together, (i) the high yield notes, bearing interest at a rate of 5.875% and maturing in 2020, issued by the Company on 23 April 2014, (ii) the high yield notes, bearing interest at a rate of 6.5% and maturing in 2021, issued by the Company on 31 May 2011, 20 January 2017 and 13 March 2017, and (iii) the high yield notes, bearing interest at a rate of 6.875% and maturing in 2022, issued by the Company on 1 May 2014;

“Convertible Bonds” means, together, (i) the convertible bonds (obligations à option de conversion et/ou d’échange en actions nouvelles ou existantes), bearing interest at a rate of 1.75% and maturing on 1 January 2020, issued by the Company on 26 June 2015, and (ii) the convertible bonds (obligations à option de conversion et/ou d’échange en actions nouvelles ou existantes), bearing interest at a rate of 1.25% and maturing on 1 January 2019, issued by the Company on 20 November 2012.

About CGG

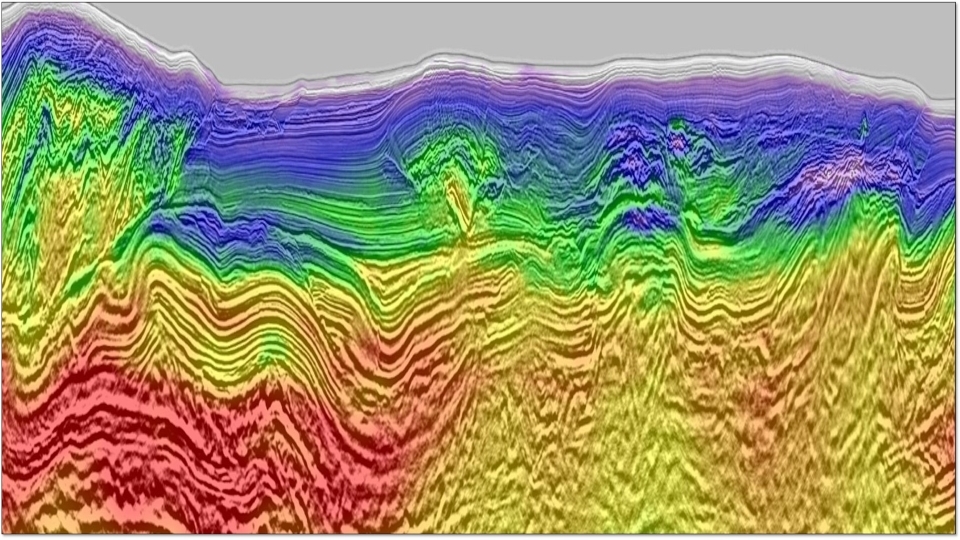

CGG (www.cgg.com) is a global geoscience technology leader. Employing around 3,700 people worldwide, CGG provides a comprehensive range of data, products, services and solutions that support our clients to more efficiently and responsibly solve complex natural resource, environmental and infrastructure challenges. CGG is listed on the Euronext Paris SA (ISIN: 0013181864).